TL;DR: The article challenges the long-held belief that China lags behind the U.

📋 Table of Contents

Jump to any section (21 sections available)

📹 Watch the Complete Video Tutorial

📺 Title: Another week, another DeepSeek, and another insane valuation for OpenAI

⏱️ Duration: 435

👤 Channel: Inside China Business

🎯 Topic: Another Week Another

💡 This comprehensive article is based on the tutorial above. Watch the video for visual demonstrations and detailed explanations.

Just one year ago, the dominant narrative in artificial intelligence was clear: Silicon Valley leads, and China lags behind by at least a generation—in chips, large language models (LLMs), and real-world applications. But as of today, that thesis has been shattered. In this comprehensive guide based on the latest insights from “Another Week Another,” we unpack how Chinese AI labs are not only catching up—they’re outperforming U.S. giants in key areas while spending a fraction of the cost. From Moonshot AI’s Kimmy K2 to Alibaba’s Qwen, and DeepSeek’s rapid rise, we explore the data, real-world deployments, valuation disparities, and what this means for investors, developers, and global tech strategy.

1. The Collapse of the “China Is Behind” AI Narrative

A year ago, conventional wisdom held that China was technologically inferior in AI—especially in semiconductors and foundational models. But the emergence of DeepSeek changed everything. This Chinese model “came out of nowhere” and directly challenged two core Silicon Valley assumptions:

- That the U.S. builds the best AI models

- That China is at least a generation behind in AI infrastructure

Today, nobody believes either claim anymore. The evidence is overwhelming: Chinese labs are producing state-of-the-art models with far fewer resources, superior cost efficiency, and rapid real-world adoption.

2. The AI Valuation Bubble in the U.S. vs. Reality in China

When DeepSeek was announced, U.S. chipmakers like Nvidia saw their stock prices hammered—briefly. But investors quickly piled back in, ignoring mounting signs of an AI stock bubble. U.S. AI valuations are now widely acknowledged as “crazy,” with no pretense otherwise.

In stark contrast, Chinese AI companies are delivering top-tier performance at extremely low valuations. This disconnect raises serious questions about sustainability, investor rationality, and long-term competitiveness.

3. Moonshot AI and the Rise of Kimmy K2

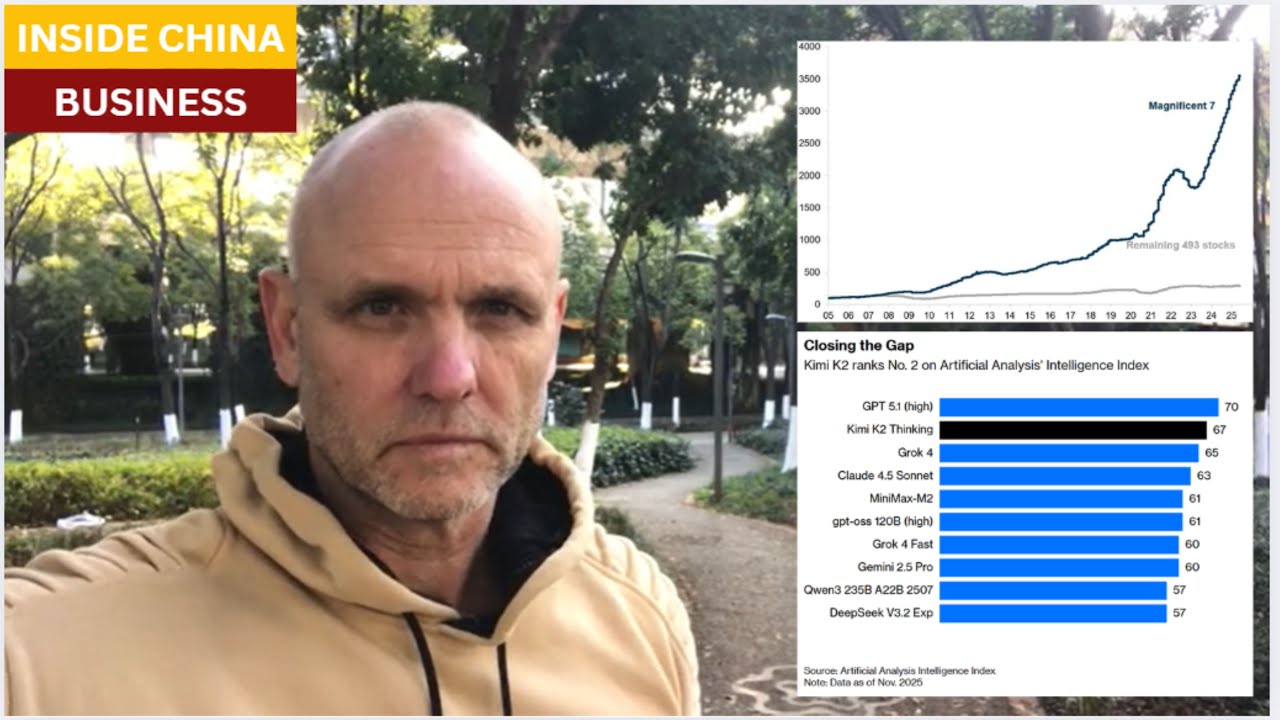

Moonshot AI, based in Beijing, recently released an open-source reasoning model called Kimmy K2. The response was immediate and enthusiastic among developers and AI researchers. Within days, Kimmy K2 was ranked #2 in its peer group on leading AI benchmark indices.

Technical reports about Kimmy K2 are dense and filled with jargon “not meant to be understood by normal human beings”—except for one critical line: its placement in the top tier of global models.

Kimmy K2’s Development Cost: A Stunning $5 Million

According to CNBC, Kimmy K2 was built for under $5 million. This figure is not just impressive—it’s revolutionary when compared to U.S. spending.

4. The U.S. Spending Spree: $500 Billion for Stargate

In the United States, the Stargate project—backed by Microsoft and OpenAI—is seeking $500 billion to build infrastructure for ChatGPT’s proprietary systems. The goal? To recoup that investment by charging users enough to justify the outlay.

This represents a 100,000x cost difference compared to Kimmy K2’s development budget. The question isn’t just about efficiency—it’s about whether such spending can ever yield a reasonable return on investment (ROI).

5. Valuation Chasm: OpenAI vs. Moonshot AI

The market reflects this imbalance dramatically:

| Company | Model | Valuation | Development Cost (Reported) |

|---|---|---|---|

| OpenAI | ChatGPT | $500 billion | $500 billion (Stargate infrastructure) |

| Moonshot AI | Kimmy K2 | ~$3 billion | <$5 million |

OpenAI is now the world’s most valuable private company, yet its model is being outperformed or matched by Chinese alternatives costing orders of magnitude less.

6. Chinese Models Dominate Global AI Benchmarks

On a leading AI model index ranking the top 10 systems globally, four are from Chinese companies:

| Rank | Model | Company | Origin |

|---|---|---|---|

| 2 | Kimmy K2 | Moonshot AI | Beijing, China |

| – | Minimax M2 | Minimax | Shanghai, China |

| – | Qwen | Alibaba | China |

| 10 | DeepSeek | DeepSeek | China |

This isn’t a fluke—it’s a trend. As Thomas Wolfier observed: “Are these new breakthroughs out of China in the AI space just going to be a regular thing?” The answer appears to be yes.

7. The Core Paradox: Inferior Chips, Less Money, Equal (or Better) Performance

Chinese labs operate under significant constraints:

- Access to inferior chips due to U.S. export controls

- Far less capital than U.S. tech giants

Yet, they consistently produce models that perform as well as or better than proprietary systems from America’s top firms. This defies traditional tech economics and suggests Chinese teams are achieving superior algorithmic efficiency and engineering ingenuity.

8. Real-World Case Study: Airbnb Chooses Qwen Over ChatGPT

Perhaps the most damning evidence comes from real-world deployment. Airbnb, led by CEO Brian Chesky—a personal friend of OpenAI’s Sam Altman—did not use ChatGPT for a critical new AI feature.

Instead, Airbnb built an AI-powered customer service agent using Qwen from Alibaba. This system allows users to easily change or cancel reservations and is being rolled out in English first, with over 50 additional languages planned.

Why Qwen Won

Airbnb’s engineers chose Qwen because:

- It’s very good at complex tasks

- It’s fast

- It’s cheap to deploy

- ChatGPT’s developer tools aren’t mature enough for production use

As the transcript notes: “That feature is available in English now… Airbnb mostly relied on Qwen from Alibaba.”

9. Qwen’s Secret Weapon: Real-Time Scientific Translation

Alibaba’s Qwen has already solved the language translation problem at an advanced level. Millions of Chinese engineers use it to communicate in real time with global peers, translating complex scientific and technical questions with high accuracy.

This capability extends to design features and multilingual UI interactions—making it trivial to implement features like a “cancel reservation” button for users in Boston or Barcelona.

The transcript emphasizes: “That’s the easiest thing anyone used Qwen for this month.”

10. DeepSeek 2: Another Chinese Powerhouse

Alongside Qwen, DeepSeek 2 is noted for its shockingly good translation and design capabilities. These models are not just research curiosities—they’re battle-tested in commercial environments across Asia.

In fact, the transcript states: “Here in Asia, Qwen is killing everyone else in commercial applications, in business apps.”

11. The ROI Crisis for U.S. AI Investors

The central question is no longer whether U.S. companies can stay ahead—that ship has sailed. The real issue is: What will the return on investment be?

After trillions of dollars are spent on U.S. AI infrastructure, these systems now compete against Chinese labs producing comparable or superior models for just millions of dollars. This imbalance threatens the entire financial model underpinning the U.S. AI boom.

12. Wall Street’s Short Memory and Market Denial

Despite clear evidence of disruption, Wall Street investors keep pouring money into U.S. AI stocks. After initial sell-offs post-DeepSeek, they “piled right back in.” This behavior suggests either:

- A short memory regarding market corrections

- Or a willful ignorance of competitive threats

Either way, the market is ignoring a fundamental shift in AI’s center of gravity.

13. The New AI Reality: Performance ≠ Price

Historically, better AI meant higher costs. Today, that correlation is broken. Chinese models prove that high performance can be achieved at ultra-low cost through smarter architecture, efficient training, and focused engineering.

This decoupling forces a reevaluation of what investors are actually paying for: brand? hype? or real capability?

14. Implications for Developers and Enterprises

For developers, the message is clear: Chinese open-source models like Kimmy K2 and Qwen are production-ready and often superior to proprietary U.S. alternatives. Enterprises looking to cut costs while maintaining quality should seriously evaluate these tools.

The Airbnb case proves that even companies with deep pockets and Silicon Valley connections are making the switch.

15. The Language and Localization Advantage

Chinese AI models have a native advantage in multilingual support—not because of English fluency, but because of their real-world use in cross-border technical collaboration. This has driven rapid iteration on translation, context retention, and cultural nuance.

As a result, deploying features across 50+ languages is not a future goal—it’s a current capability.

16. Open Source vs. Proprietary: A Strategic Shift

Kimmy K2’s release as an open-source reasoning model accelerates global adoption and community improvement. In contrast, U.S. models remain largely closed, limiting transparency and third-party innovation.

This openness gives Chinese models a network effect advantage that proprietary systems can’t match.

17. The Future of AI Competition: Efficiency Over Expenditure

The next phase of AI won’t be won by who spends the most, but by who delivers the most value per dollar. Chinese labs are leading this efficiency revolution, forcing a global reset in AI development philosophy.

18. Actionable Takeaways for Tech Leaders

Based on the insights from “Another Week Another,” here’s what leaders should do:

- Evaluate Chinese models like Qwen, Kimmy K2, and DeepSeek for your next AI project

- Question ROI assumptions behind expensive U.S. AI subscriptions

- Monitor open-source Chinese repositories for rapid innovation

- Reassess language and localization strategies using Qwen’s translation capabilities

- Prepare for valuation corrections in overhyped U.S. AI stocks

19. Conclusion: The AI World Order Has Shifted

The transcript from “Another Week Another” delivers a sobering yet clear-eyed view: China is no longer catching up—it’s leading in key dimensions of AI. With models that are cheaper, faster, and often better, Chinese labs are redefining what’s possible. Meanwhile, U.S. companies risk becoming overvalued relics if they don’t adapt.

For investors, developers, and enterprise leaders, the message is urgent: Look beyond Silicon Valley. The future of AI is global, efficient, and increasingly open—and it’s being built in Beijing, Shanghai, and Hangzhou today.

20. Resources and Models to Explore

Based on the transcript, here are the key Chinese AI models to investigate:

- Kimmy K2 by Moonshot AI (open-source reasoning model, ranked #2 globally)

- Qwen by Alibaba (dominant in commercial apps, multilingual translation)

- DeepSeek (ranked #10, strong in design and translation)

- Minimax M2 by Minimax (Shanghai-based, top-tier performance)

These are not theoretical—they’re deployed at scale, saving companies millions, and outperforming trillion-dollar ecosystems.

The era of U.S. AI dominance is over. Welcome to the new reality—brought to you by Another Week Another.